Some Known Factual Statements About Homeownership Assistance: Nevada - HUD

USDA Home Loan Eligibility Search in Lincoln County, Nevada

Some Of Nevada's USDA Loan Income Limits by County

Qualifying applicants get an adjustable grant with different loan types, including FHA, VA, USDA, or the Fannie Mae HFA Preferred Traditional loan. All Home at Last loans are 30-year, fixed rate mortgages, and the grants do not have actually to be repaid.

When it's time to purchase your very first house, there's plenty to consider, and where you choose to purchase is necessary. Nevada draws citizens thanks to industries including aerospace and defense, gaming and tourism, mining and natural deposit management. I Found This Interesting 's the seventh-largest state by landmass, though only around 3 million people call The Silver State home.

Cheryl Dresen, Reno, NV - USDA Home Loans - PrimeLending Fundamentals Explained

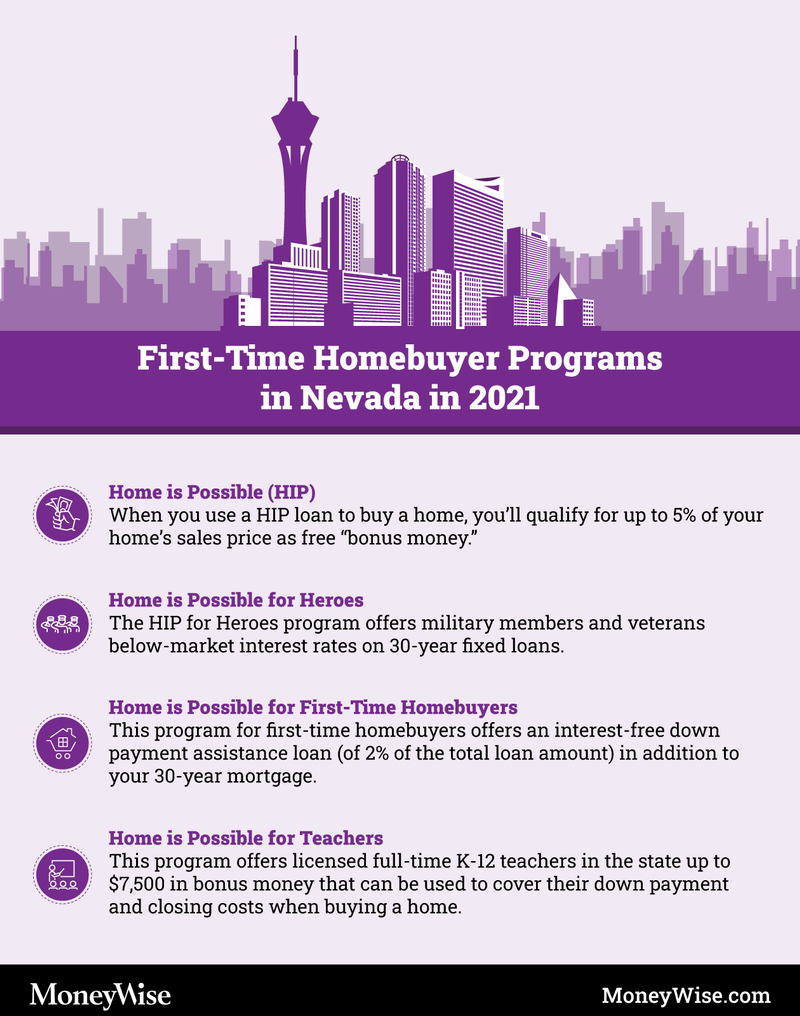

When it comes to acquiring your first home, the Nevada Housing Division can be an important resource. The firm was created by the state in 1975 to assist low- and moderate-income households and people protected economical housing. Here's what you require to know about the organization's programs for first-time property buyers.

Among the Home Is Possible programs is a home loan specifically for novice homebuyers, which features deposit assistance of up to 4 percent of the overall loan amount as a 2nd home mortgage, forgivable after 3 years (so long as you remain in the home). A novice buyer is somebody who has not owned a house in the past 3 years.

USDA Rural Development Loan - Temecula, CA - USA Home Financing

USDA Loans — Omega Mortgage Group

USDA Home Loans - NV Rural Housing Loan - Greater - Questions

Debtor requirements: 660 minimum credit rating Maximum 45 percent debt-to-income ratio Should complete complimentary property buyer education course (readily available online) Need to meet NHD earnings limits, which depend upon county; the most affordable limitation is $75,000 for two or less people in Churchill, Clark, Esmeralda, Lincoln, Lyon, Mineral, Nye, Pershing and White Pine counties, and the greatest limitation is $119,600 for 3 or more individuals in Eureka County Need to pay one-time fee of $755, due at closing Property requirements: Need to be a single- or two-family house, condo, townhouse, manufactured home (except with Freddie Mac); can also be a four-unit house if you live in among the units as your main residence Must remain in Nevada Should be a primary residence Should satisfy NHD purchase price limits, which vary by county and variety from $294,601 to $408,477 NHD Home Is Possible Program, Aside from the novice homebuyer mortgage and support used through Home Is Possible, the NHD also offers newbie and repeat purchasers a comparable home mortgage and deposit support by means of the program, approximately 5 percent of the total loan quantity.